Water funds are taking off like a wildfire in Latin America. But like a wildfire, they run the risk of burning too hot and too fast to help the ecology (and the people) in the system. The rapid expansion of water funds in latitudes south has presented some challenges for The Nature Conservancy and its partners, which are trying to make the most of a potentially great tool for bringing nature’s value into the real economy.

These challenges hinge around four tough questions:

- How can water funds get the biggest return on investment for both ecosystems and people?

- What science can be brought into play fast enough and with small enough data and capacity requirements to be useful?

- Can one scientific approach work for all funds, or do we have to start over each time?

- And above all else, do water funds actually work?

Luckily, there has been a lot of experience in developing and investing in water funds in Latin America. The Natural Capital Project (NatCap) and the Latin America Water Funds Platform (a partnership among TNC, the Inter-American Development Bank, GEF and FEMSA) are collecting lessons learned and best practices from across the region to answer these questions and turn that experience into a standardized, science-based approach to designing water fund investments.

Standardizing approaches to water fund portfolio design

The first two questions prospective water fund investors usually ask are 1) how should we spend the fund’s money? and 2) what are we going to get for it? In a recent workshop in the Dominican Republic, a group of practitioners and scientists found that their experiences aligned around the need to be able to answer these investment questions with a rigorous yet flexible return-on-investment approach.

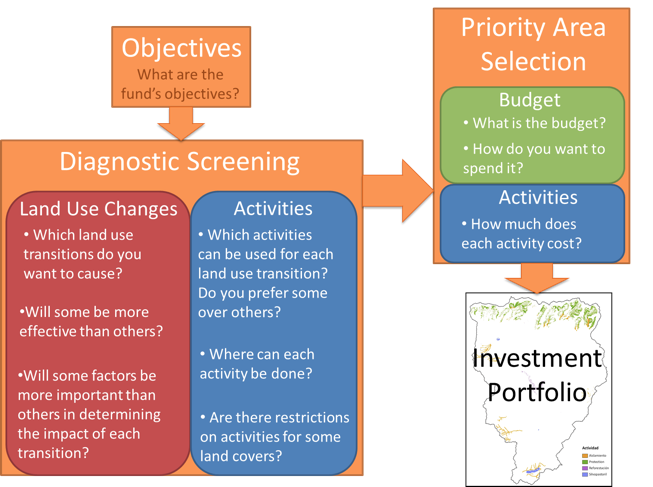

From there, the Platform and NatCap decided jointly to develop a tool that would do just that. Tentatively named RIOS (short for Resource Investment Optimization System), this tool will standardize water fund investment design and provide water fund managers with answers to three core questions: (1) What set of protection and restoration actions will give the biggest return on investment? (2) What will that return on investment be? and (3) How much better is that return than what we would have achieved without the tool?

How does it work?

RIOS uses biophysical data (i.e. topography, soils and land uses) and simple representations of demand (i.e. where are the people that depend on the resource?) to identify places where activities like protection or restoration are likely to give the biggest returns for water fund objectives. Water funds are usually trying to get a lot for their money, including improvements in terrestrial and/or freshwater biodiversity as well as a long list of water-related benefits. While the current iteration of RIOS can’t help with that entire list, it can identify the best places to invest for some of the most desired water benefits: water quality purification (nutrients and sediments), reservoir maintenance, flood mitigation and groundwater recharge.

Figure 2: User’s view of RIOS. The tool connects 5 core components to create investment portfolios. Each question in the diagram is answered through a data input provided by the user.

For each of these benefits, RIOS uses a relative ranking approach to identify the areas of highest potential returns. The tool also considers important information about social conditions that will affect implementation of investments such as stakeholder preferences, legal limitations on where activities can occur, locations of security concerns and so on. Together, these relative returns show where investments will be both beneficial and feasible.

Using data provided by the user on activity costs and budget levels, RIOS calculates a relative return on investment (ROI) for each activity. Investment areas are chosen based on ROI until the fund’s money runs out. In the end, water fund investors are given an “investment portfolio,” a map that shows where and in what activity they should invest (see Figure 1).

RIOS was first tested at a workshop in Mexico in April 2012. We produced a portfolio for the Monterrey fund in northern Mexico during the workshop and got feedback from fund developers from across Latin America.

This approach still doesn’t answer the question of precisely what the fund will get for investing in that portfolio of sites. As with many conservation strategies, we simply don’t have the data to answer that question rigorously. The uncertainty stems in part because the answer will change for each fund, depending on the starting state of the watershed, the technologies used to deliver water to users in different sectors, the laws regulating water access and fees and so on. So what can we do?

First, we can do more monitoring. But that will take time to show results. In the meantime, investors need to have some sense that their money will indeed provide some return. So RIOS uses the InVEST (Integrated Valuation of Ecosystem Services and Tradeoffs) suite of models to estimate how much return the fund can expect towards each objective. These models estimate the actual change in ecosystem services and their values if the portfolio were implemented as designed. If the fund has a quantitative goal, like reducing water pollution by 10%, the tool will show whether the budget they are proposing is big enough to meet that goal. These estimates of returns that can be tested over time as monitoring data reveal what real returns accrue. This part of the tool will be tested in Lima, Peru in August, where we will see if the tool is flexible enough to develop portfolios and estimate returns for funds in Mexico, Peru, Panama, Colombia and Brazil.

Of course, using RIOS will take time and money, and many water funds have made it thus far without it. We think it’s important to include a way to ask just how much better off fund investors will be if they use this new tool. While we continue to ask for funds to help us monitor and study ecosystem service returns on the ground, we need something today. So we use the same InVEST models to estimate returns from more “business-as-usual” portfolios (those that haven’t been optimized through a guided design). RIOS compares estimates from the “designed” portfolio to the business-as-usual one, to give a sense of how much the science improves investment returns.

Generalized, flexible tool for a regional approach

From concept to design, RIOS was created with the vision of improving returns from conservation investments, presenting scientific information in a way that is useful for managers and being flexible enough to be applied in many different environmental, social and legal contexts. None of this is very helpful if there isn’t anyone to use RIOS. Luckily, the enabling conditions being developed by the Water Funds Platform gives us a real opportunity to take what has been one-off, site-based work on water funds to the continental scale.

Of course, there is still the question of whether or not any of this actually works, for biodiversity or people. We have very little evidence thus far in terms of cold, hard data from existing water funds on whether investments in watershed management do in fact lead to system-scale changes in hydrology and user-level improvements in benefits. We are, however, finally well poised to start generating these data. NatCap is contributing to another effort being led by TNC to standardize biodiversity and ecosystem service monitoring across water funds. Funding is in place for several monitoring programs to start on the ground this year, giving us a chance in the coming years to start learning whether in the end, nature and people are better off.

By Heather Tallis and Adrian Vogl, Natural Capital Project, Stanford University

Top figure: Example of an water fund investment portfolio created with RIOS. The left image shows where each activity is feasible, based on information provided by stakeholders. The next image shows the integrated ROI scores for the fund’s activities, and the final image is the investment portfolio that was selected based on ROI and the fund’s budget.